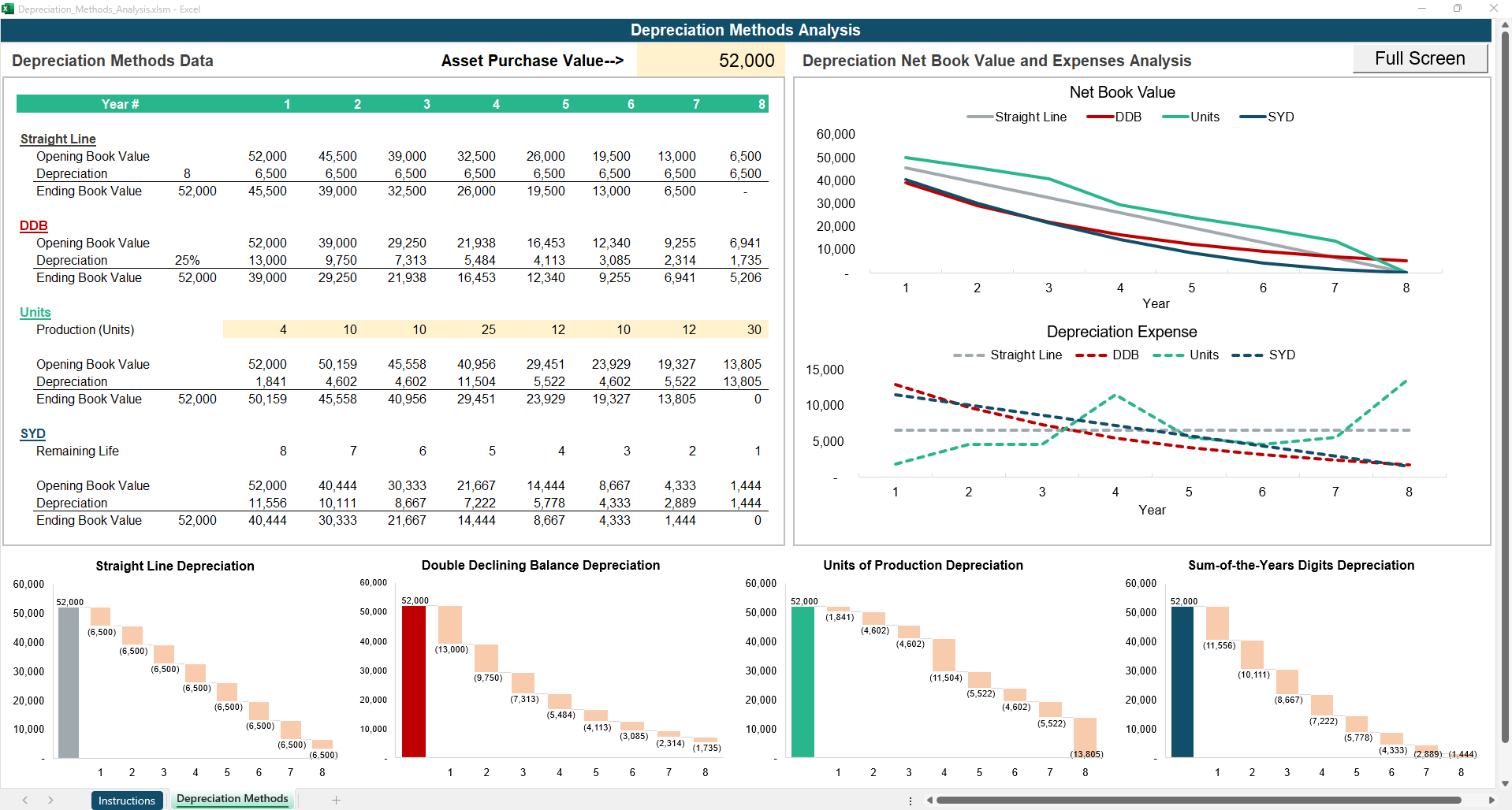

Depreciation Methods Analysis

$9.99

Optimize asset management and financial planning with the Depreciation Methods Analysis template. Evaluate different depreciation methods, such as straight-line, declining balance, or sum-of-years'-digits, to determine the most suitable approach for your assets. Compare depreciation expenses, tax implications, and financial reporting impacts to make informed decisions and maximize tax benefits. Whether managing tangible assets, such as equipment or vehicles, or intangible assets, such as software or patents, this template provides valuable insights to optimize depreciation strategies and enhance financial performance. Stay compliant, efficient, and strategic in managing asset depreciation.